Year-to-Date (YTD) is a fundamental financial metric that offers a comprehensive view of financial performance from the start of the year to the present date. Understanding YTD is essential for effective financial and business planning, providing insights into earnings, expenses, and overall performance.

What is YTD?

Definition of YTD

YTD stands for Year-to-Date, representing the period from January 1st to the current date within the same calendar year. This metric aggregates financial data for this specific timeframe, providing a snapshot of how an individual or business is performing relative to the beginning of the year.

Importance of YTD

YTD data is crucial as it helps in evaluating ongoing financial performance. For individuals, YTD information allows tracking of earnings and expenses, ensuring alignment with financial goals. Businesses use YTD figures to assess profitability, manage budgets, and forecast future performance.

Read More: Understanding DG Paystubs

YTD Meaning in Different Contexts

YTD in Personal Finance

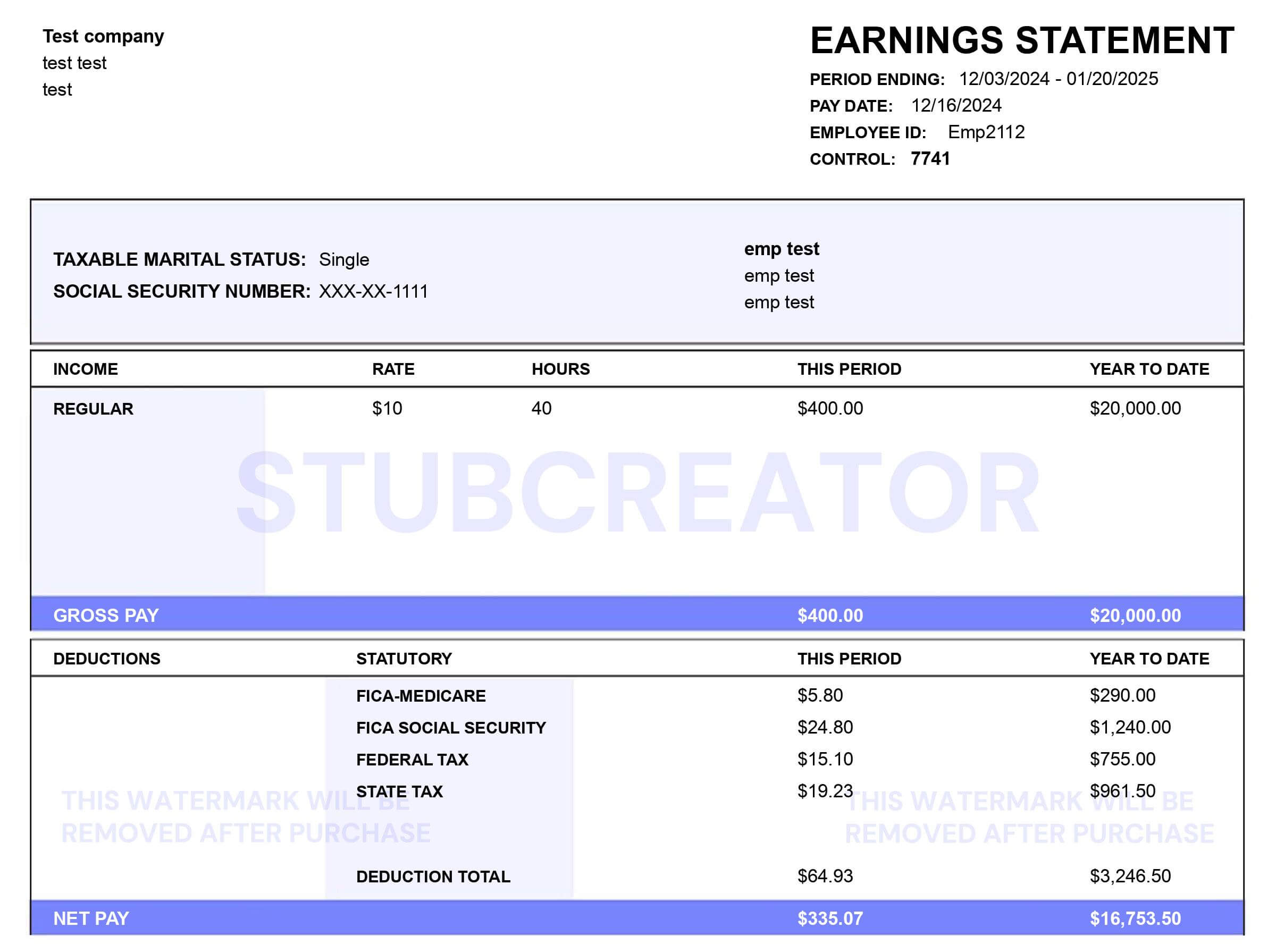

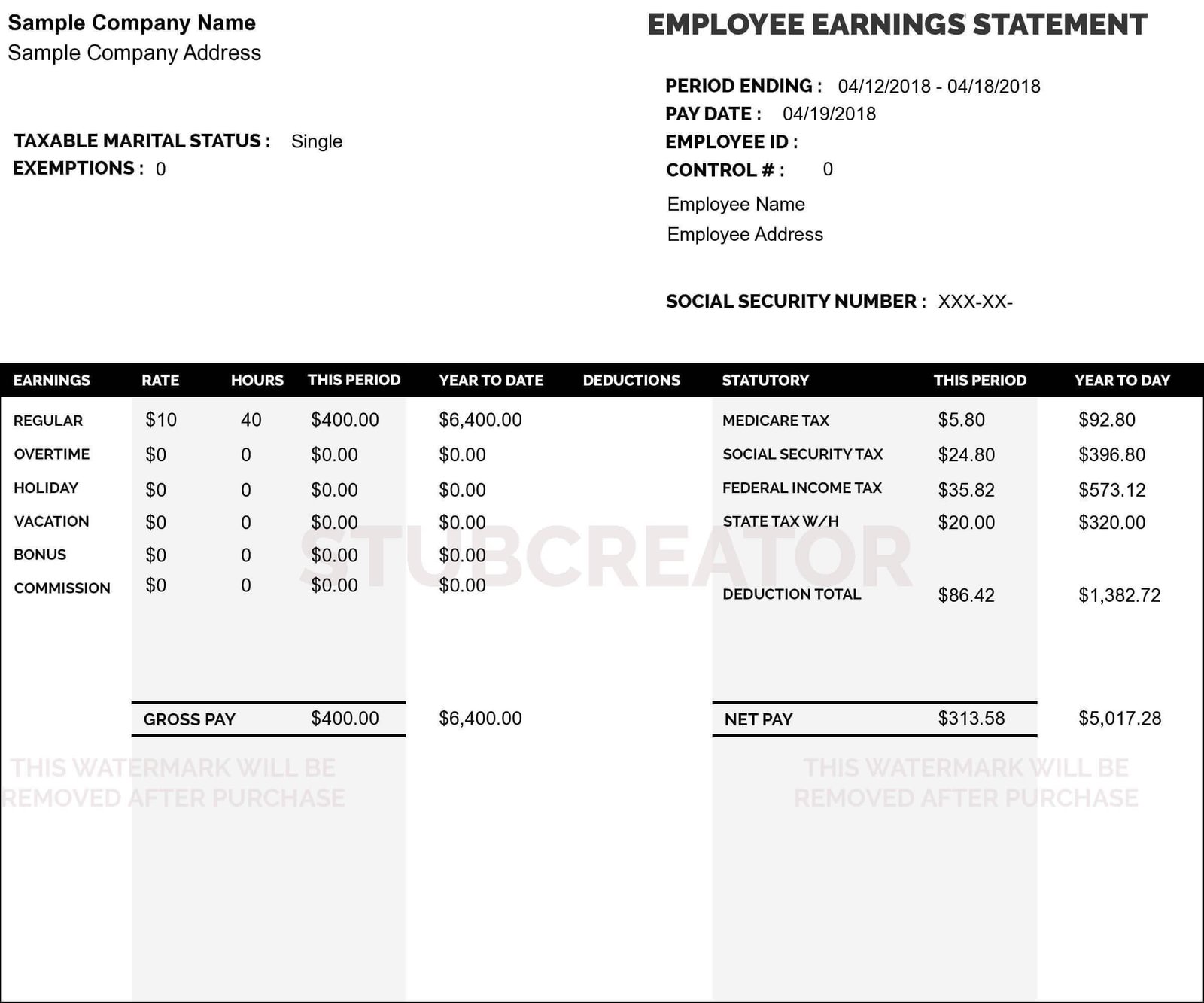

For individuals, YTD figures are essential for monitoring personal finances. YTD statements on pay stubs, investment accounts, and expense reports help track overall progress towards financial goals, such as savings targets or debt reduction. Reviewing YTD data assists in making informed decisions about adjusting personal budgets.

YTD in Business

In the business realm, YTD data plays a vital role in financial management. Businesses utilize YTD metrics to compare current performance against annual budgets, evaluate profitability, and make strategic adjustments. This data is integral for accurate forecasting and effective decision-making.

Where to Get YTD Pay Stubs

Accessing YTD Information

Employees can access their YTD pay stubs through their company’s payroll system or HR department. Most payroll systems provide online access to pay stubs, including YTD information. If YTD pay stubs are not readily available, employees should request them from their HR department.

Online Tools and Platforms

There are several online tools and platforms where individuals can retrieve their YTD pay stubs. Paystub generator and payroll services often provide options to view and download YTD information. Examples include online payroll services like ADP or Paychex, and free paystub generator tools.

What Does YTD Mean for Financial and Business Planning?

Utilizing YTD Data for Personal Budgeting

Individuals can use YTD data to review their financial progress and make necessary adjustments. By analyzing YTD earnings and expenses, one can refine their budget, set new financial goals, and manage personal finances more effectively. This data helps in tracking progress towards savings and debt reduction.

Leveraging YTD Data in Business Planning

Businesses leverage YTD data to evaluate their performance against annual goals. This information is crucial for making strategic adjustments, managing costs, and improving financial forecasts. By comparing YTD figures with budgeted amounts, businesses can better understand their financial position and plan for future growth.

Related Article: How to Get a McDonald’s Pay Stubs?

Practical Examples and Case Studies

Personal Finance Example

Consider an individual who reviews their YTD pay stubs to assess their spending habits and savings progress. By comparing YTD earnings with expenses, they can identify areas where they can cut costs and increase savings, ultimately leading to better financial management.

Business Case Study

A retail business tracks YTD sales to evaluate its performance relative to annual sales targets. By analyzing YTD sales data, the company identifies trends and adjusts its marketing strategies to improve sales performance for the remainder of the year.

Conclusion

Understanding YTD is essential for both personal and business financial planning. By accurately tracking and analyzing YTD data, individuals and businesses can make informed decisions, set realistic goals, and manage their finances effectively. Utilize YTD data to gain valuable insights and improve your financial and business planning.

Frequently Asked Questions

What is YTD (Year-to-Date)?

YTD stands for Year-to-Date and refers to the period from January 1st of the current year up to the present date. It summarizes cumulative financial data for this timeframe.

Why is YTD important for personal finance?

YTD is crucial for tracking earnings, expenses, and savings throughout the year. It helps individuals monitor financial progress, adjust budgets, and stay on track with financial goals.

How does YTD data help businesses?

For businesses, YTD data is used to evaluate performance against annual goals, manage budgets, and make strategic decisions. It provides insights into revenue, expenses, and profitability.

Where can I find my YTD pay stubs?

You can access YTD pay stubs through your company’s payroll system or by requesting them from your HR department. Many payroll services and online tools also provide access to YTD information.

What does YTD mean on my pay stub?

On a pay stub, YTD represents the total earnings, deductions, and taxes from the beginning of the year up to the current pay period. It helps in understanding overall financial status.

How often should I review my YTD data?

It is advisable to review YTD data regularly—such as monthly or quarterly—to ensure that financial goals are being met and to make timely adjustments to budgets and plans.

Can YTD data be used for tax purposes?

Yes, YTD data can be useful for tax purposes as it shows cumulative income and deductions. This information helps in preparing accurate tax returns and assessing potential tax liabilities.

What should I do if my YTD figures don’t match my annual totals?

Discrepancies between YTD figures and annual totals may indicate errors in data entry or reporting. Review your pay stubs and financial records carefully and consult with your payroll department or accountant if needed.

Are there tools available to help manage and analyze YTD data?

Yes, there are various online tools and software, such as pay stub generators and financial management apps, that help in managing and analyzing YTD data. These tools provide detailed reports and insights.

Understanding YTD data to improve their financial forecasting?

Businesses can use YTD data to identify trends and adjust their financial forecasts. By comparing YTD performance with annual targets, businesses can make informed predictions and strategic adjustments to improve future performance.