When it comes to managing your finances and ensuring accuracy in your payroll documentation, understanding and effectively using paystubs is crucial. For those using Trubridge for payroll services, knowing how to access and utilize your Trubridge paystubs can make a big difference. This blog will explore everything you need to know about Trubridge paystubs and how a paystub generator or paycheck generator can help streamline the process.

What is Trubridge?

Trubridge is a comprehensive HR and payroll services provider known for offering solutions that simplify payroll management for businesses of all sizes. Whether you’re a small business owner or an employee, Trubridge aims to make payroll processing more efficient and accurate.

What is a Paystub?

A paystub, also known as a paycheck stub or payslip, is a document provided by an employer that details an employee’s earnings and deductions for a specific pay period. It typically includes information such as gross pay, taxes withheld, and other deductions like health insurance or retirement contributions. Paystubs are essential for tracking your earnings, filing taxes, and verifying income.

Why Are Trubridge Paystubs Important?

Trubridge paystubs are crucial for several reasons:

- Income Verification: When applying for loans or renting a property, you might need to provide proof of income. Trubridge paystubs serve as official documentation of your earnings.

- Tax Filing: Accurate paystubs are vital for correctly filing your taxes. They help you understand how much you’ve earned and how much has been deducted for taxes.

- Financial Planning: By reviewing your paystubs regularly, you can better manage your finances and budget effectively.

- Dispute Resolution: If there are any discrepancies in your pay or deductions, having detailed paystubs can help resolve disputes with your employer.

How to Access Your Trubridge Paystubs

Accessing your Trubridge paystubs is straightforward:

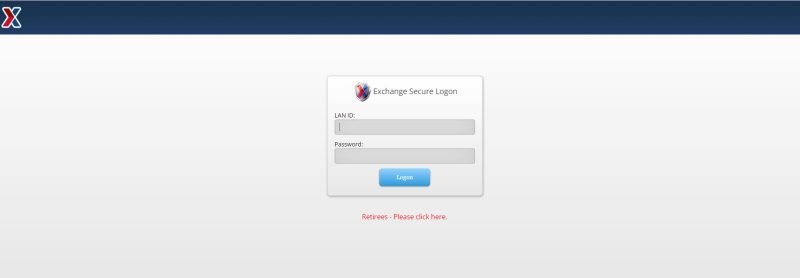

- Log In to Trubridge: Start by logging into your Trubridge account. You should have received login credentials from your employer.

- Navigate to Paystubs: Once logged in, navigate to the payroll or paystub section. Here, you will find a list of your pay periods.

- Download or View Paystubs: Select the pay period you want to view or download your paystub. You can often download it as a PDF for easy storage and sharing.

- Contact Support: If you encounter any issues or cannot access your paystubs, contact Trubridge’s customer support for assistance.

Using a Paystub Generator

If you need to create paystubs for any reason, such as for a new job or for personal record-keeping, a paystub generator can be incredibly helpful. Here’s how it works and why it might be useful:

- What is a Paystub Generator?: A paystub generator is an online tool that allows you to create paystubs by entering your earnings, deductions, and other relevant information. It generates a paystub that looks professional and can be used for various purposes.

- Why Use a Paystub Generator?: If you are self-employed or need to create paystubs for a new business, a paystub generator can help you produce accurate documents quickly. It’s also useful if you need to provide proof of income but do not have access to traditional paystubs.

- How to Use a Paystub Generator:

- Enter Your Details: Input your name, company name, pay period, earnings, and deductions.

- Review and Customize: Make sure all details are correct. Some generators allow you to customize the appearance of the paystub.

- Generate and Download: Once you’re satisfied with the details, generate the paystub and download it in your preferred format (usually PDF).

- Things to Consider: While paystub generators are convenient, ensure the information you enter is accurate. Incorrect or falsified paystubs can lead to legal issues or disputes.

How a Paycheck Generator Differs

A paycheck generator is similar to a paystub generator but focuses on creating the actual paycheck or direct deposit slip rather than just the documentation. It often includes fields for payment amounts, bank details, and other specifics related to the actual payment process.

- Benefits of a Paycheck Generator:

- Accuracy: Helps ensure the correct amount is processed and recorded.

- Ease of Use: Simplifies the process of creating and issuing paychecks, especially for small business owners.

- How to Use:

- Input Payment Details: Enter the amount to be paid, the payee’s information, and any other necessary details.

- Generate and Print: Create the paycheck and print it or send it electronically, depending on your needs.

Common Issues and Solutions

Even with the best tools, you might encounter issues with paystubs or paychecks. Here’s how to address some common problems:

- Incorrect Information: If you notice errors on your paystub or paycheck, contact your employer or payroll department immediately to correct them.

- Missing Paystubs: If you do not receive a paystub, check your email or Trubridge account. If it’s still missing, reach out to your employer or Trubridge support for assistance.

- Trouble with Generators: If you face difficulties with a paystub or paycheck generator, ensure you’re using a reliable tool. Look for reviews or recommendations to find a trustworthy generator.

Final Thoughts

Understanding how to access and use your Trubridge paystubs, along with knowing how to effectively use paystub and paycheck generators, is essential for accurate financial management. Whether you’re verifying income, filing taxes, or managing payroll, having the right tools and information at your disposal can make the process smoother and more efficient.

By following the steps outlined in this blog, you can ensure that your paystubs and paychecks are accurate and reliable, helping you stay on top of your finances with ease. If you have any further questions or need assistance, don’t hesitate to reach out to Trubridge support or explore trusted online tools for additional help.

Read Related Articles

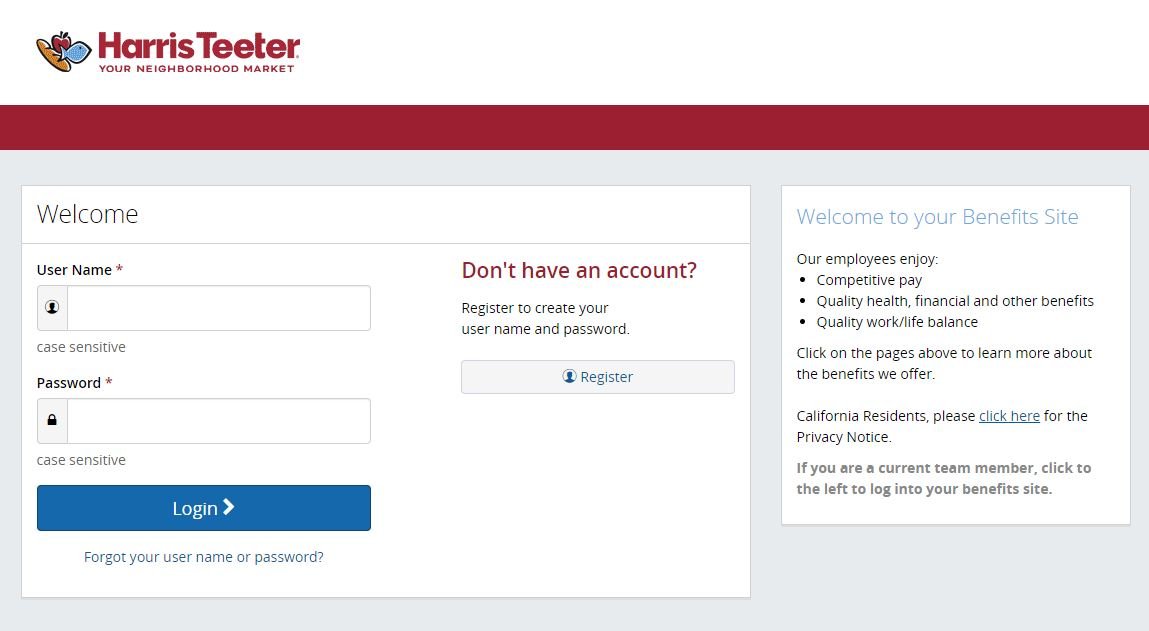

How to Access Your MyHTSpace Pay Stub?