Employer and Employee ID Numbers (EINs) are crucial identifiers used in payroll and tax systems to distinguish individuals and businesses. In this comprehensive guide, we will delve into what these numbers entail, how to find them, and their significance on check stubs.

What Is an Employee ID Number?

An Employee ID Number, commonly referred to as an employee ID numbers or employee ID, is a distinctive numerical identifier allocated to each employee within a company. This unique code plays a crucial role in payroll processing, HR management, and maintaining comprehensive employee records. It serves as a fundamental component in systems integrated with paystub generator, ensuring accurate documentation and facilitating streamlined administrative processes.

How to Find Employee ID Numbers?

Finding your Employee ID Number typically involves the following steps:

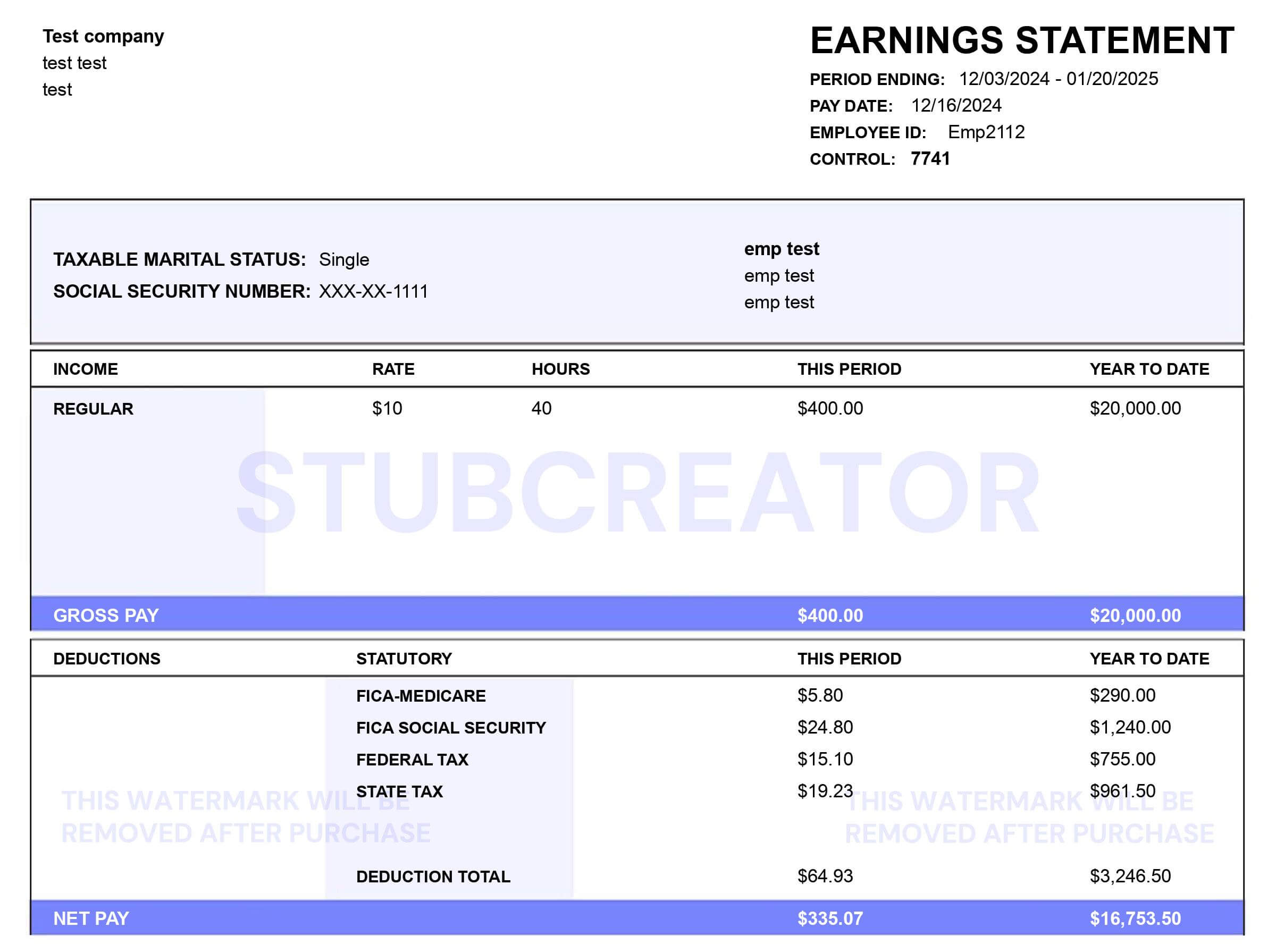

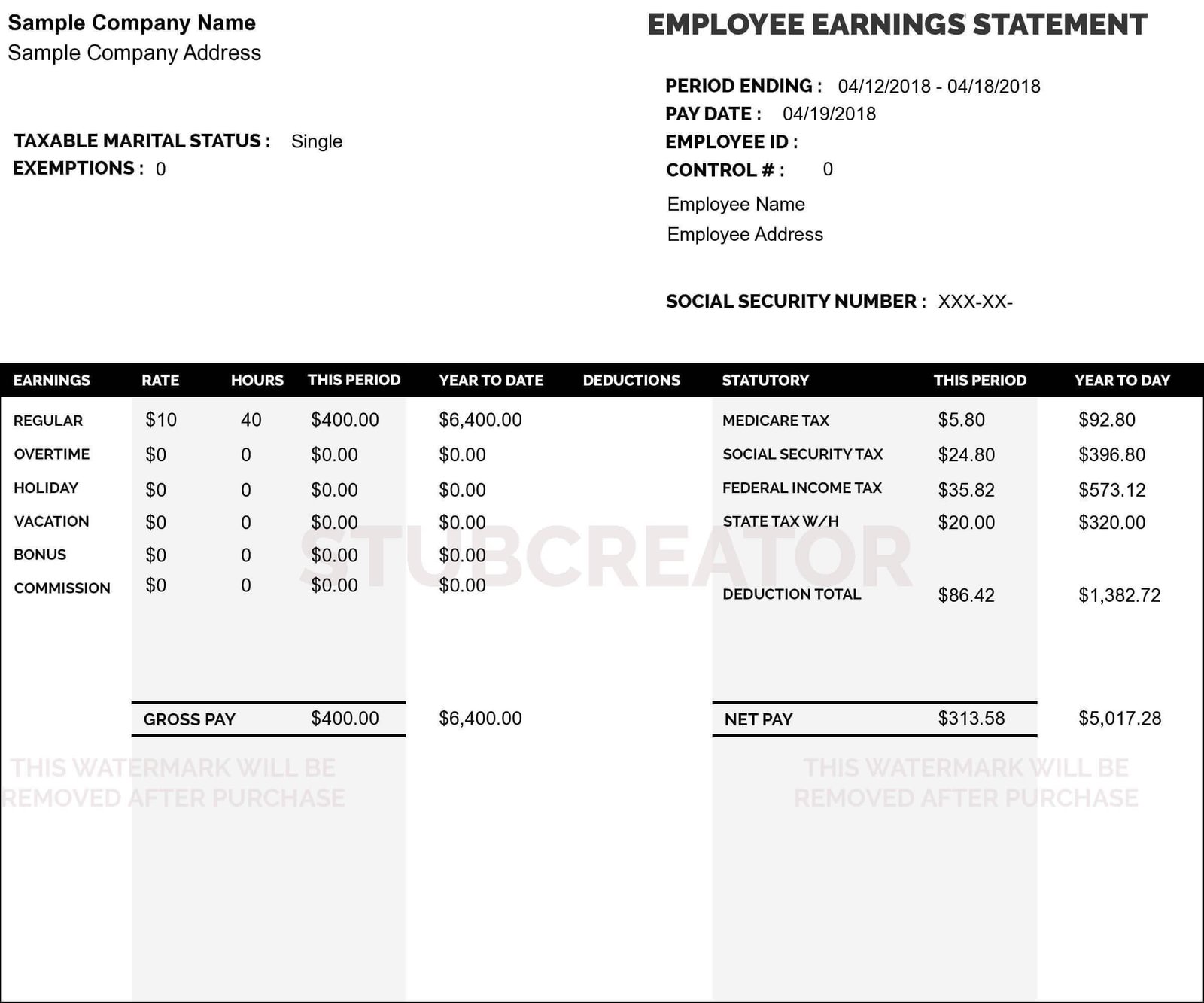

- Check Your Pay Stub: Your Employee ID Number is often printed on your pay stub alongside other payroll details.

- HR or Payroll Department: Contact your company’s HR or payroll department if you cannot locate your Employee ID Number on your pay stub. They can provide assistance in retrieving this information.

- Employee Portal or HR Software: Many organizations provide access to employee portals or HR software where employees can view and also update their personal information, including their Employee ID Number.

Related Article: Understand DG Paystubs

What Is an Employer Identification Number (EIN)?

How to Find Federal Employer Identification Number?

Businesses can find their EIN through various methods:

- IRS Notification: Businesses receive their EIN from the IRS upon registering for tax purposes. The IRS sends a confirmation letter that includes the EIN.

- Business Documents: The EIN is typically listed on various business documents, such as tax returns, payroll records, and banking documents.

- IRS Online Services: Businesses can use the IRS’s online services, such as the EIN Assistant tool, to look up their EIN if they have misplaced the original notification letter.

Does the Check Stub Have My Employer’s EIN?

Yes, your check stub typically includes your employer’s EIN, also known as the Employer Identification Number. This nine-digit identifier is crucial for tax purposes and is prominently displayed alongside other important payroll details on your pay stub. The EIN allows both employees and employers to accurately report income, deductions, and withholdings to the IRS. It ensures compliance with tax regulations and provides a clear record of earnings that is essential for financial planning and filing tax returns. Understanding and verifying the presence of your employer’s EIN on your pay stub is important for maintaining accurate financial records and also fulfilling tax obligations efficiently.

Read More: How to Access Your MyHTSpace Pay Stub?

Difference Between Employer ID Number And Employee ID Number

While both types of IDs serve to identify individuals or entities, there are key differences:

- Employee ID Number: Assigned to individual employees within an organization for HR and payroll purposes.

- Employer Identification Number (EIN): Assigned to businesses and other entities by the IRS for tax reporting and business identification.

The Employee ID Number pertains specifically to an individual’s role within an organization, whereas the Employer Identification Number identifies the business entity itself for tax and regulatory purposes.

Importance of Understanding ID Numbers on Check Stubs

Understanding and correctly identifying Employee and Employer ID Numbers on check stubs is crucial for:

- Tax Compliance: Ensuring accurate tax reporting and withholding.

- Payroll Processing: Facilitating smooth payroll operations and employee record-keeping.

- Employee Management: Streamlining HR processes and maintaining accurate employee records.

- Business Identification: Meeting regulatory requirements and business identification needs.

Final Thoughts on Employee ID on Paystub

In summary, both Employee Identification Numbers (Employee IDs) and Employer Identification Numbers (EINs) serve critical functions in the realms of payroll, tax reporting, and overall business operations. For employees, the Employee ID Number is a unique identifier assigned within an organization, essential for HR management, payroll processing, and employee record-keeping. It typically appears on pay stubs, providing employees with a clear reference point for their earnings and deductions.

On the other hand, businesses and entities operating in the United States are assigned an Employer Identification Number (EIN) by the IRS. This nine-digit identifier is pivotal for tax purposes, enabling businesses to report income, deductions, and other financial details accurately. Employers can find their EIN through official IRS correspondence, tax documents, or online services provided by the IRS.

Understanding the distinction between Employee IDs and EINs is crucial for maintaining compliance with tax regulations and facilitating efficient business operations. Employees rely on their Employee IDs to access company benefits, track earnings, and ensure accurate tax filings. Employers, meanwhile, use their EINs to fulfill tax obligations, manage payroll effectively, and maintain regulatory compliance.

By grasping the importance of these identification numbers, both employees and employers can streamline administrative processes, enhance financial transparency, and contribute to the overall efficiency of their respective roles within the organizational framework. This understanding not only supports smooth HR management and payroll operations but also ensures accurate reporting to regulatory bodies, fostering a robust foundation for sustainable business practices.

Frequently asked Questions (FAQs) about Employee and Employer Identification Numbers (EINs)

What is an Employer id Numbers (EIN), and why is it important on my pay stub?

An EIN is a unique nine-digit identifier issued by the IRS to businesses for tax purposes. It’s crucial on your pay stub as it helps identify your employer for tax reporting and compliance.

Where can I find my employer’s EIN on my pay stub?

Your employer’s EIN is typically located alongside other payroll details, often near your personal information or deductions section. It’s essential for accurately reporting income to the IRS.

How do I verify the accuracy of my employer’s EIN on my pay stub?

You can cross-check your employer’s EIN on your pay stub with official tax documents provided by your employer or through IRS resources like tax filings and also documentation.

Can I use my employer’s EIN for tax filing purposes?

Yes, your employer’s EIN is used when filing your taxes. It ensures that the income reported on your pay stub matches the records maintained by the IRS for accurate tax reporting.

What should I do if I can’t find my employer’s EIN on my pay stub?

If you cannot locate your employer’s EIN on your pay stub, first check with your HR or payroll department for assistance. They can provide you with the correct EIN or guide you on where to find it. It’s essential for accurate tax reporting and financial record-keeping.