The comparison between W-2 and W-4 forms sparks a lengthy discussion within the working class regarding tax documentation. If you’re an employer or an employee, the tax forms have significance in terms of your financial documentation. They come in handy while filing tax returns with the IRS.

The practice of filing the tax forms can be a challenging task especially if you lack the understanding of its implications and its importance. Though, it is not necessary to be a tax professional in order to differentiate between the two fo them if they are misplaced by you.

In this blog, we will highlight the differences between W-2 vs W-4 pointing out the main differences between them. Let’s get started.

What is a W-2 Form?

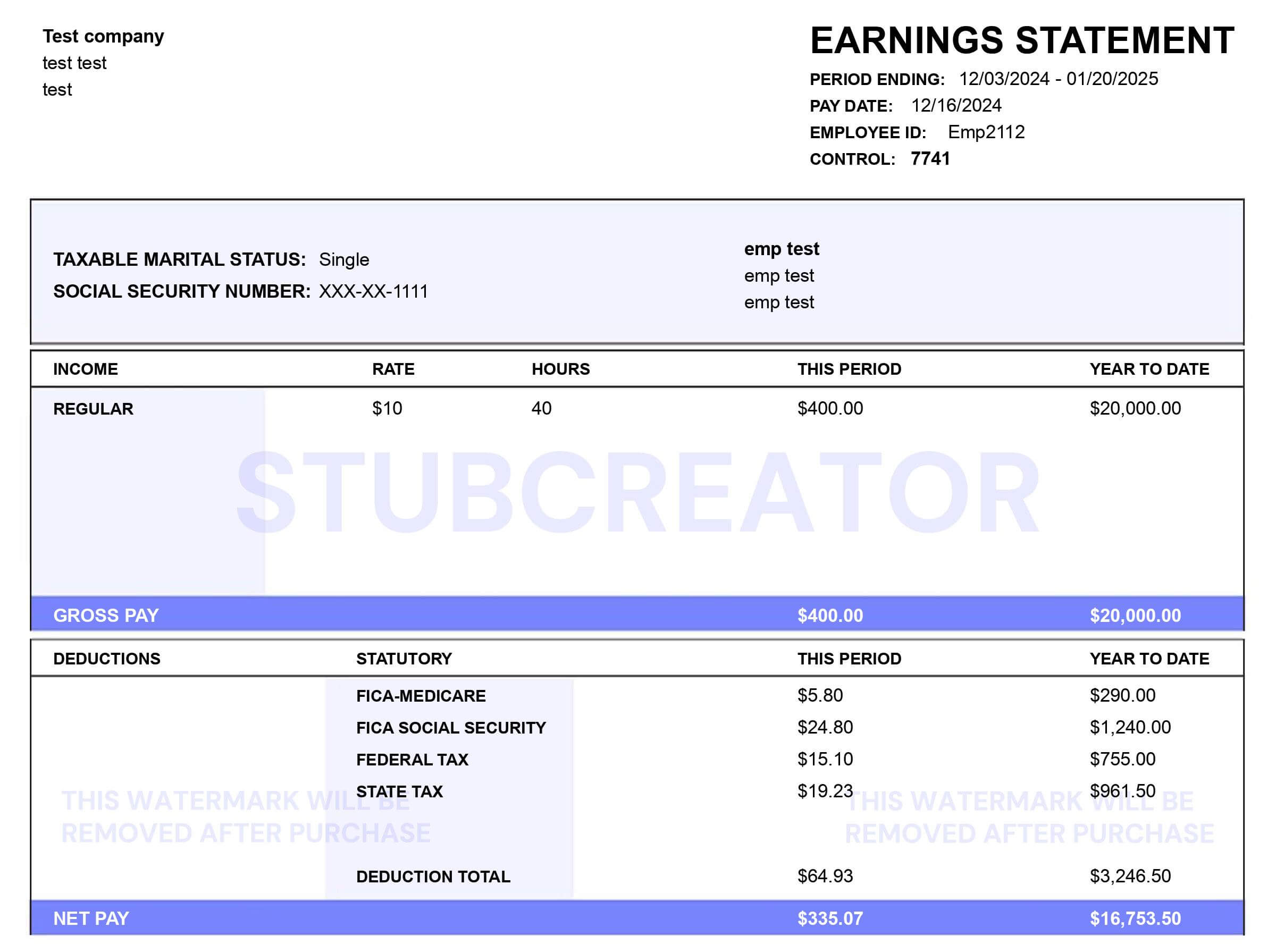

A W-2 form is a document that the IRS issues to an employee’s earnings and tax withholdings. The legal term for this is: Wage and Tax Statement- a document that fulfills only one purpose that is to establish a bridge between your earnings and your tax liability.

The W-2 form presents accurate details about your earnings and deductions for tax purposes, representing the employer-employee relationship. In essence, it shows the income earned by the employee, and the withholding tax amount which is essential when filing state and federal taxes. And surprisingly, if you are looking for a free W2 form generator, then let me tell you our W-2 generator has got you covered. And, if you are looking for a free W2 form generator, then our W2 generator has covered you from all sides.

When it comes to showcasing your income and taxes deduction by your boss, the Wage and Tax Statement – often called the IRS – produces a thorough summary. To accurately manage your taxes, it’s expected that you receive W-4 and W-2 forms from your employer, showing your latest earnings.

However, in addition to regular taxes withheld from the employees paycheck the whole year, including federal income tax, social security, medicare and state taxes; though employers are solely responsible for finishing the form with its details in regard to the employee salary, tips and bonus.

What is a W-4 Form?

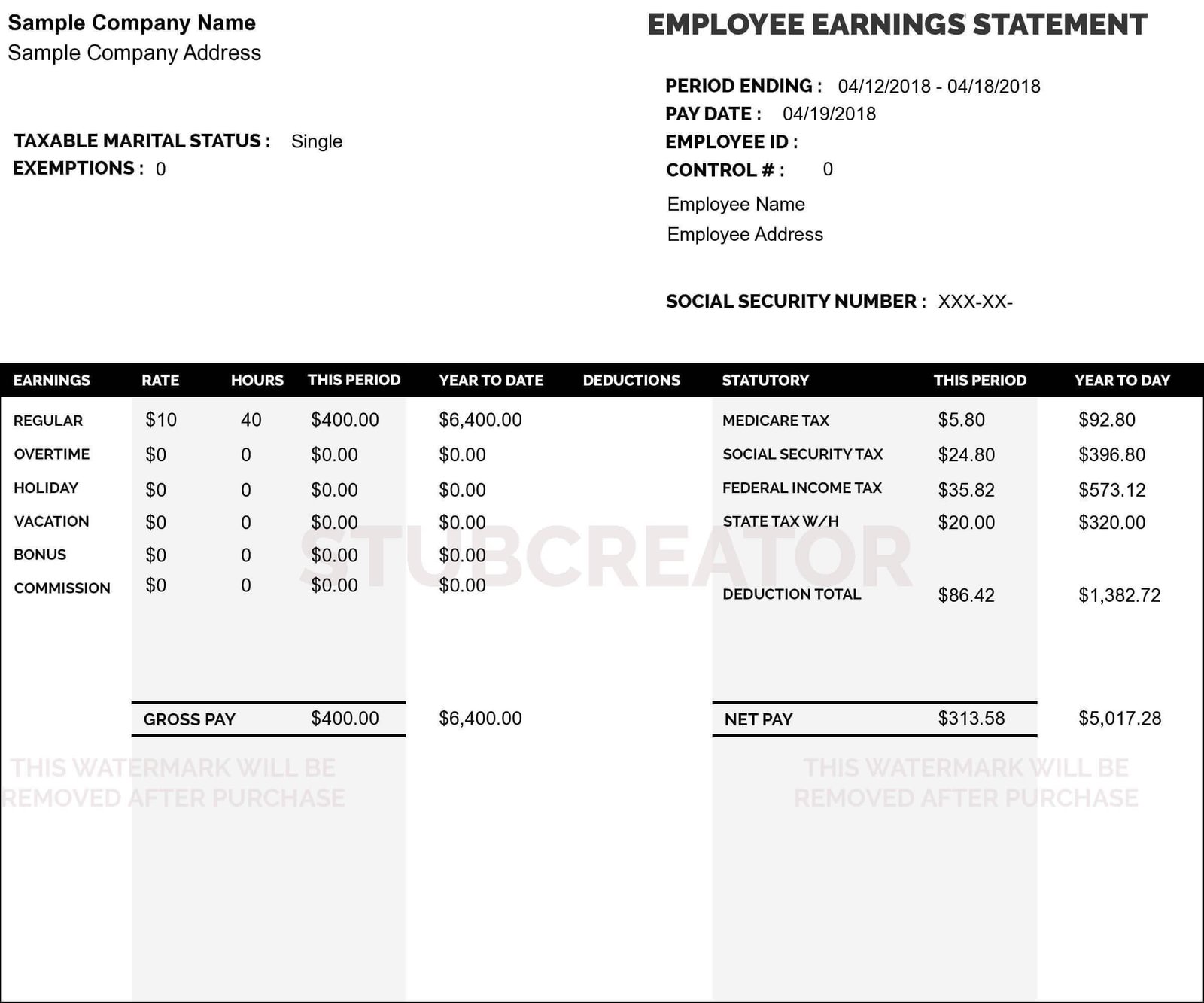

Like the W-2, the W-4 form also implements the flow of data between employer and employee. Notably, it primarily performs the opposite function of its counterpart. Rather than an employee receiving financial information, the W-4 is intended to advise an employer on how much income to withhold for tax purposes.

Given the rules and regulations, it’s essential to frequently evaluate and update your W-4 form, which instantly informs your employer about any alterations in your financial status. We reiterate that this approach ensures employers know exactly the amount to retain while keeping your income free of obstruction.

The (IRS) Internal Revenue Service also known as the Employee’s Withohlding Allowance Certificate grants you to inform your employer with standard identification details like social security number, current living address and martial status.

When you’re hired by a firm, you are given a W-4 form. To make sure that the things are on the simpler side, just fill out the form by inserting some of your personal details like marital status, how many dependents you have, tax exemptions you have been provided. These details will specify household typical deductions.

Your W-4 form directly affects how much your employer withholds from every paycheck to cover state and federal taxes. You can either pay more per paycheck or pay less at the conclusion of the year, or you can even pay less per paycheck and pay more.

W-2 VS W-4: What’s The Real Difference?

The W-4 form differs from the W-2 form in that it arms your boss with the requisite information needed to calculate how much they should take out from your wages. Thus, while the W-2 form is the responsibility of the employer, completing the W-4 form is your duty as an employee. Simply put, the two forms have inversely different roles.

When is the best time to file them: W-4 form vs. W-2?

Business proprietors and workers should understand precisely when to file each of the forms to prevent delays and miscommunication. Though the W-4 form provides you with employer information about how much money to withhold for income taxes, you, as an employee,should fill out your W-4 form on the first day of your job.

Generally, you should update your W-4 form according to your finances as they keep changing with new rules and regulations. By adopting this method, you can guarantee that you pay the precise amount of taxes.

But, if your income and taxes are in stable condition, then you may need to be concerned about the yearly W-4 form filing. If the employer is responsible for finishing the W-2 form for their employees, then they should do it before 31st January every year.

The only reason is that every filing provides details of the tax withholding from the previous year. For instance, should a business owner have finalized a W-2 form for an employee by January 31, this signifies that the form encompasses the tax particulars and payroll data from the prior year.

Conclusion

Despite belonging to the category of IRS tax forms, the W-2 and W-4 forms exhibit notable dissimilarities. These disparities extend to their completion process, filing requirements, as well as the individuals responsible for their submission. Gaining a thorough comprehension of the disparities between W-2 and W-4 forms is imperative to avoid unintentional tax debt and maintain consistency in tax matters. In order to create a w2 form you can visit eFormscreator.