Do you need to generate contractor pay stubs for your business? You have landed on the perfect page. Being an independent contractor, staying on top of the right side of the IRS is vital. Paystubs provide detailed information about your earnings, taxes, and employer-paid benefits.

In this blog, we shall provide a solid insight into independent contractor pay stubs and how to create paystubs for self-employed individuals.

It is challenging to manage your paperwork when you are self-employed. As compared to traditional employees, you generally do not receive a pay stub that showcases your earnings and tax deductions.

Knowing How To Read A Pay Stub

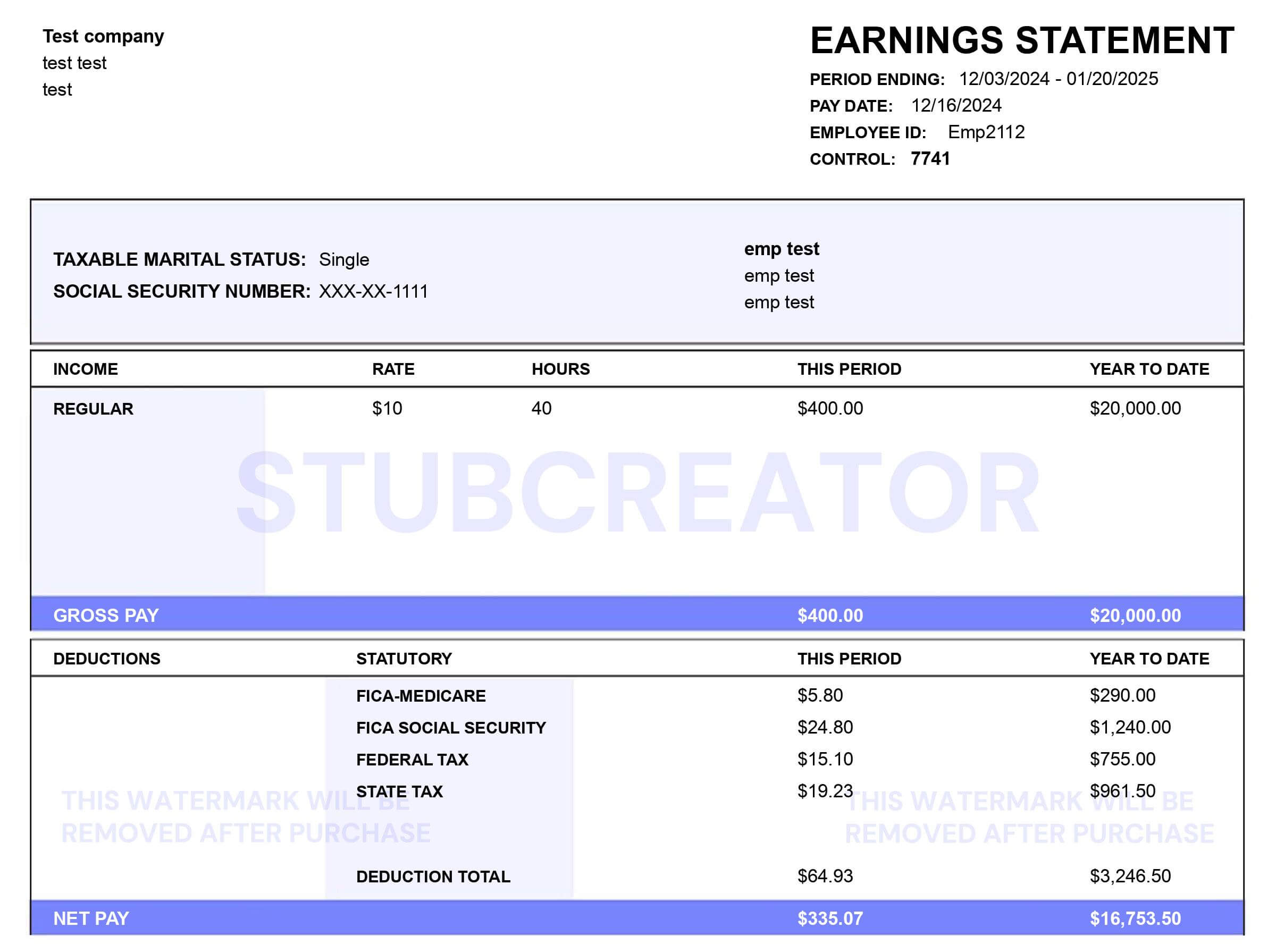

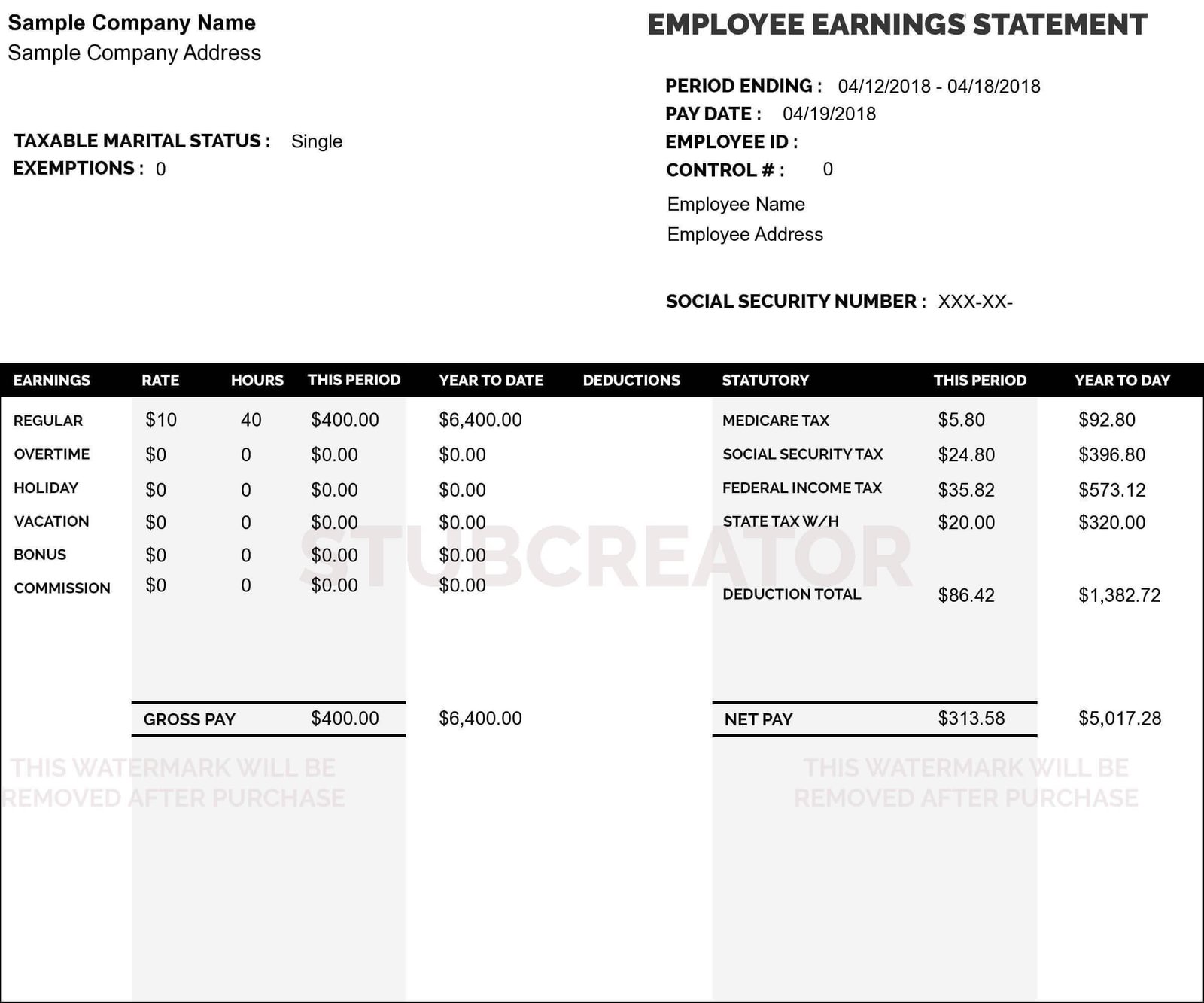

Understanding the difference between current and year-to-date figures is vital while reviewing a paystub. Both are crucial, and the YTD balances assist the firm and the employee determine whether the amounts are accurate.

A pay stub summarizes wages, tax deductions, and benefit deductions. On the other hand, independent contractors’ pay stubs have no deductions from their pay.

States have different laws governing pay stubs. Though some states mandate it, others do not. Employers are required to open up their wage information to employees. Businesses should check laws in each state where they have employees to ensure they are compliant.

As evidence of income, workers should save their current pay stubs. When someone requests a loan, the pay stub verifies their gross income.

Generating Independent Contractor Pay Stubs

Before we dive into the contractor pay stubs needs, let us discuss how employers typically address pay stubs and all considerations around this. A pay stub is a document that summarizes an employee’s wages and deductions for a given pay period. It can be used for various reasons like payroll tax calculation, reporting to government agencies like the IRS, and employee benefit tracking.

Employers use different methods to generate paystub. Some employers print out paper check stubs for their employees, while others print them out via an online portal, which they can access via an app. The decision to print paper stubs is based on how many employees are being paid each paycheck because it can be costly to print a vast number of copies simultaneously.

25% of U.S. adults report paying late for goods and services in the last 12 months, including 16% who took more than one month to pay their bills. Some might consider this a financial hardship that makes paying bills difficult, including lack of income or medical emergency.

Pay Stub Software/Tool

Many firms use software or tools like eFormscreator to generate paystub for their employee. It can be tempting to download one of these paystubs for your records but beware, it might fail to meet your expectations.

Employers must provide pay stubs in various situations: when employees request them or state law requires it.

The best way to generate a custom pay stub template is to write down everything you want on yours when you get paid- go back through each line and identify which line statements are taxable or non-taxable.

It is vital to know the name of your employer, the number of hours you have worked in the last week, your gross wage earned by you, and any kind of deductions made on your behalf.

Creating A Paystub for Independent Contractor

Since you work for yourself, you do not get a traditional paycheck. That’s okay. You can use a free online application to create your own pay stub.

Keep in mind these steps:

- Decide your home state.

- Choose whether the pay stub is for the employee or for you.

- Insert your personal information.

- State your company’s information.

- Finish any remaining field if left.

- Include any withholdings.

Once you select the template and provide the necessary information, you can download your independent contractor pay stub to generate a quick online payment.

W-2 Form or 1099 Paystub?

Watch out for your documents if you still need clarification. The form the employee receives from their employer is the W2 form. This contains annual compensation and provides information on tax deductions and health insurance. This contains annual compensation and provides information on tax deductions and health insurance.

The appropriate form for independent contractors is a 1099-MISC form. It includes the entire income you earned for the year without any deductions.

Conclusion

An independent contractor paystub is vital to the modern tax system and includes in-depth tax data, contract information, and benefits. As an independent contractor, you must stay on top of your payments and pay stub information because they improve the likelihood of a strong, mutually beneficial relationship with the agencies and beyond. If you want to create paystub eFormscreator is the best choice to move forward with!