Accessing your Army and Air Force Exchange Service (AAFES) pay stubs is crucial for managing your finances effectively. Whether you’re a current or former AAFES employee, having easy access to your pay stubs helps you track earnings, taxes, and deductions. This guide provides straightforward steps to help you obtain your AAFES pay stubs.

What is AAFES?

The Army and Air Force Exchange Service (AAFES) is a military retailer serving active-duty, Guard, and Reserve members, military retirees, and their families. AAFES operates a variety of facilities, including retail stores, gas stations, and restaurants, both on and off military installations. To ensure employees are informed about their earnings, AAFES provides electronic pay stubs accessible online.

How to Access Your AAFES Pay Stubs?

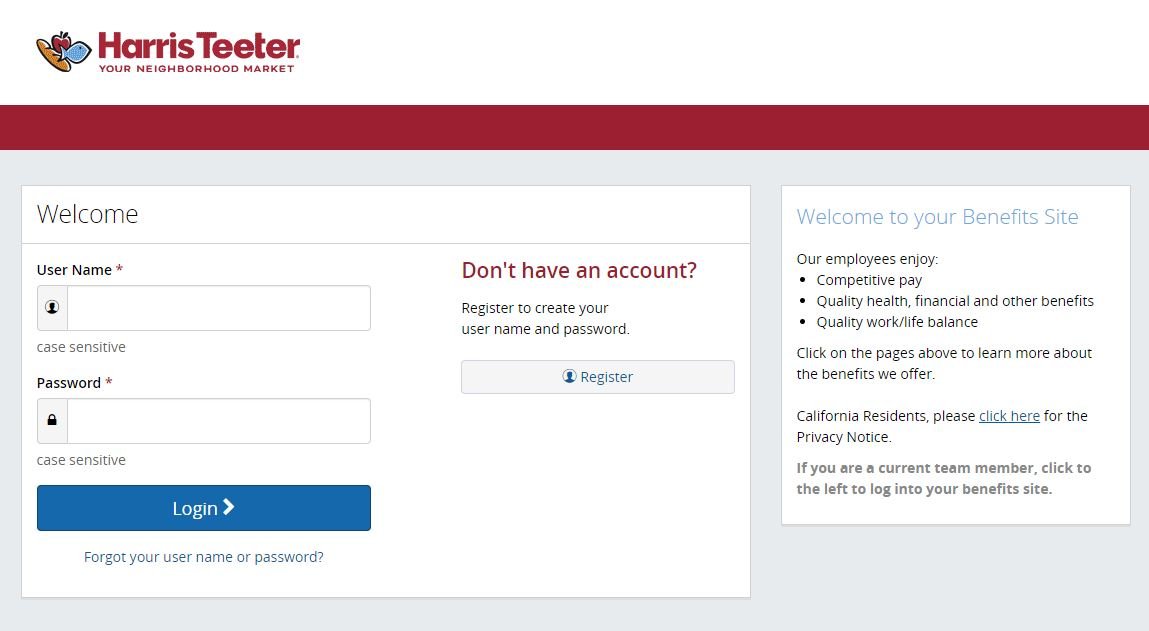

Step 1: Register for AAFES Self-Service

To access your AAFES pay stubs online, start by registering for AAFES Self-Service:

- Visit the AAFES Employee Self-Service Portal.

- Click the “Register” or “Create Account” button.

- Enter the required information, including your Employee ID and Social Security Number.

- Create a username and password for your account.

- Follow the on-screen instructions to complete the registration process.

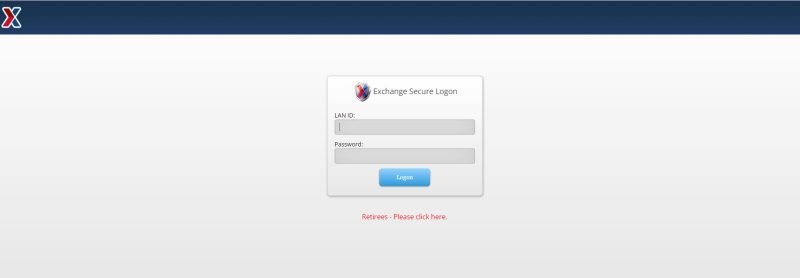

Step 2: Log In to Your AAFES Employee Self-Service Account

Once registered, you can log in to your AAFES Employee Self-Service account:

- Go to the AAFES Employee Self-Service Portal.

- Enter your username and password.

- Click the “Log In” or “Sign In” button to access your account.

Step 3: Access Your AAFES Pay Stubs

After logging in, you can access your pay stubs:

- Navigate to the “Payroll” or “Pay” section within your Self-Service account.

- Look for the option to view or download your pay stubs.

- Select the pay stub you wish to view; it will be displayed on your screen.

Step 4: Download or Print Your Pay Stubs

To keep a record of your pay stubs:

- Find the download or print option on the pay stub page.

- Choose your preferred format (PDF, Excel, etc.) for downloading.

- Click “Download” or “Print” to save or print your pay stub.

Step 5: Keep Your Pay Stubs Secure

Store your pay stubs in a secure location. Consider creating a dedicated folder on your computer or keeping hard copies in a safe place, as these documents contain sensitive financial information.

Related Article: Understanding DG Paystubs

Conclusion

Accessing AAFES pay stubs is a straightforward process that begins with registering for AAFES Self-Service. These pay stubs are essential for income verification, financial management, and meeting various financial obligations. With the help of a paystub generator, you can easily retrieve and manage your pay stubs. By following the steps outlined in this guide, you can ensure that you stay on top of your financial records and efficiently manage your earnings.

Disclaimer: Stubcreator is not affiliated with AAFES or its associates. AAFES brands or logos are trademarked or registered trademarks. This article provides general guidance for accessing AAFES pay stubs. Refer to AAFES’s official resources and consult HR for specific details.

More Related Questions and Answers

What is AAFES Self-Service?

Answer: AAFES Self-Service is an online portal that allows Army and Air Force Exchange Service employees to access their pay stubs, manage personal information, and view other employment-related details. It provides a convenient way to handle payroll and HR tasks electronically.

How do I register for AAFES Self-Service?

Answer: To register, visit the AAFES Employee Self-Service Portal, click on “Register” or “Create Account,” and enter your Employee ID, Social Security Number, and other required details. Create a username and password, and follow the instructions to complete the registration process.

I forgot my AAFES Self-Service password. How can I reset it?

Answer: On the AAFES Employee Self-Service Portal login page, click on the “Forgot Password” link. Follow the prompts to verify your identity and reset your password. You may need to provide personal information or answer security questions.

How can I access my AAFES pay stubs once registered?

Answer: Log in to your AAFES Self-Service account, navigate to the “Payroll” or “Pay” section, and select the option to view or download your pay stubs. You can view the pay stubs on-screen or download them in PDF format for your records.

Can I download or print my AAFES pay stubs?

Answer: Yes, after accessing your pay stubs through the AAFES Self-Service portal, you can download them in various formats such as PDF or Excel. There is also an option to print your pay stubs directly from the portal.

What should I do if there is an error on my AAFES pay stub?

Answer: If you find an error on your pay stub, contact your HR department or payroll office as soon as possible. Provide them with details of the discrepancy so they can investigate and correct any issues.

How can a paystub generator help with managing AAFES pay stubs?

Answer: A paystub generator can assist in creating and managing accurate pay stubs by automating calculations and ensuring compliance with tax laws. It simplifies the process of generating and organizing pay stubs, which can be particularly useful if you need to create or verify additional records.