A ratified contract secures the buyer-seller relationship, which is a permanent deal. Whether you are saving to buy a house or start a small business, you must have a legal contract that spells out all the terms and conditions of an agreement.

Though the term ratified contract is more believable in the real estate world, it finds significant relevance in a modern digital business.

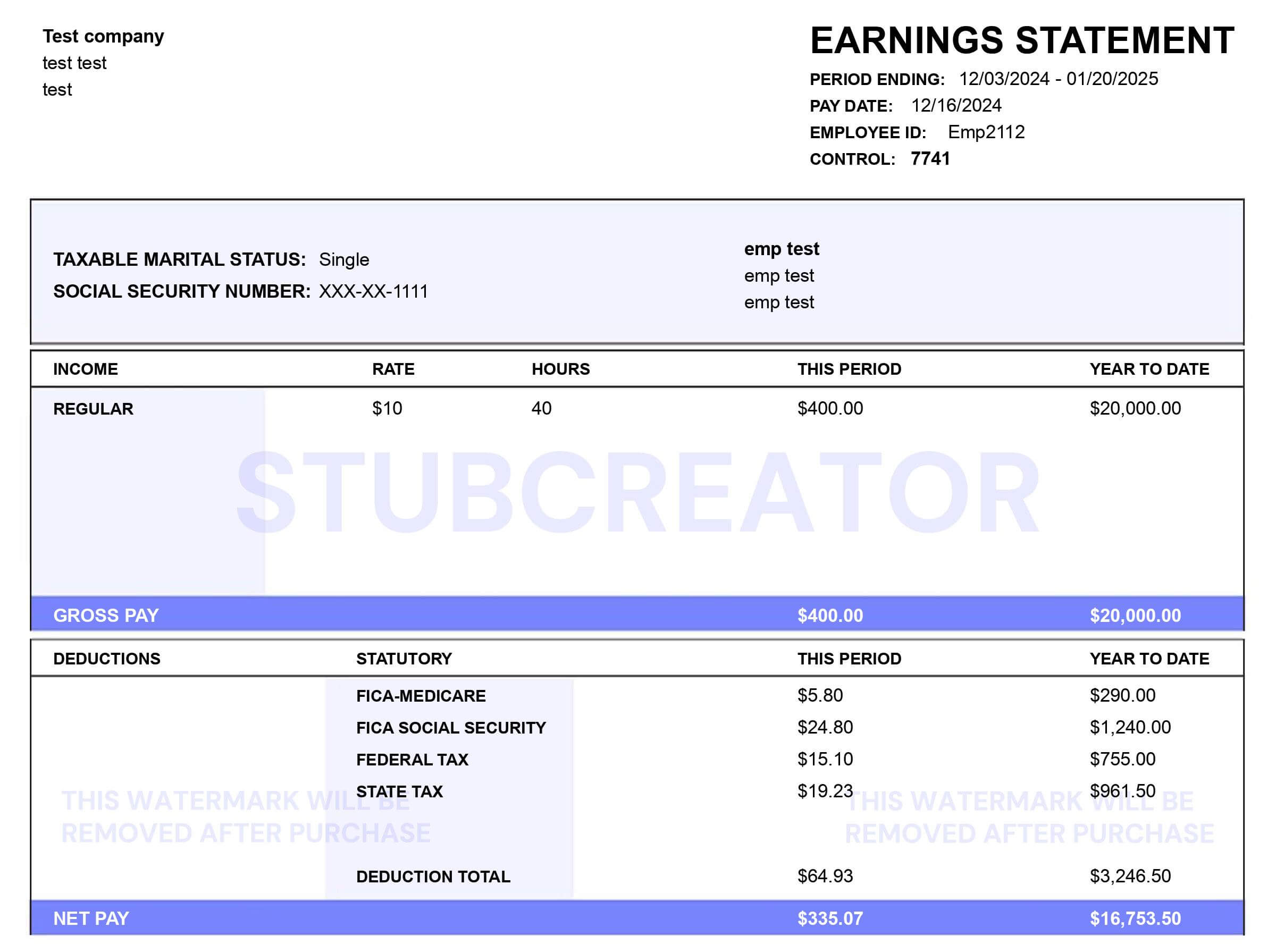

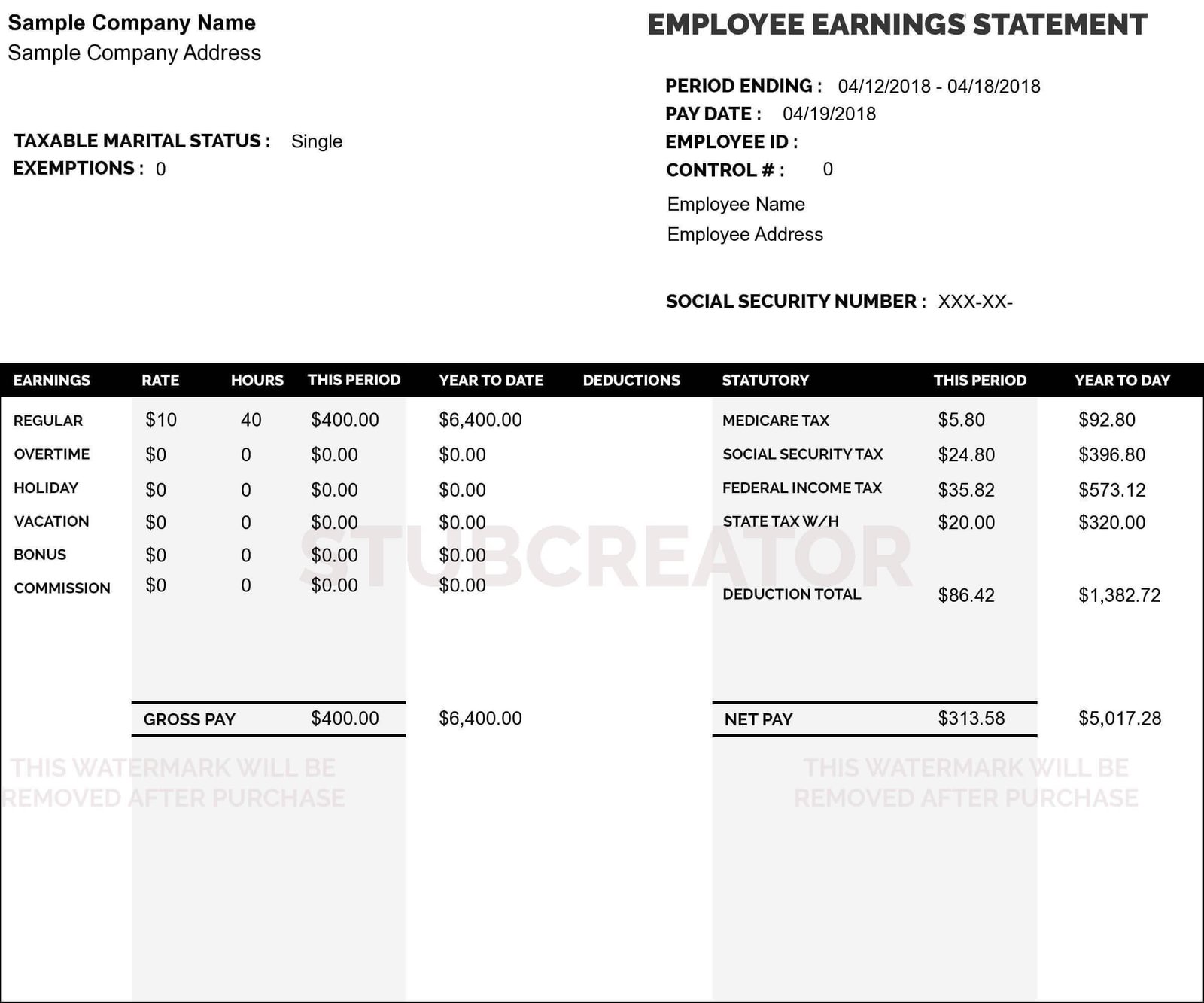

This blog will enlighten you with everything you need to know about ratified contract. If you are looking to generate paystub you should check out eFormscreator.

What is a Ratified Contract?

A ratified contract is an agreement between two parties under agreed terms and conditions waiting to sign the final contract. It is an agreement that has been approved but not necessarily signed.

Such occurrences happen when two parties enter into a negotiation, but one of the parties lacks the authority to sign the contract. So, the contract requires the interference of people carrying a higher cader of command for approval.

Why and When Do You Need a Ratified Contract?

A general understanding of negotiations and legal agreements enables you to correspond the right amount of power to your external representatives.

This will also help you avoid problematic situations and issues arising from want of legal understanding. Every buyer-seller transaction is a contract and might require further documentation and legal processes.

So, you can add online generated invoices to the transactional terms as a seller. Alternatively, you need a loan, your W-2 form, which also qualifies you to push through with the contract.

How To Ratify a Contract?

Sometimes, a contract does not offer enough assurance and coverage to guarantee business safety. Similarly, a signed contract is not always sufficient to be a binding agreement for a business owner.

For example, if your employee signs a contract on your behalf, the other parties might be required to ratify it. Ratifying a signed contract confirms that you accept the contract terms signed on your behalf.

In addition, ratifying a contract enforces it regardless of any valid reasons you may have to void it.

Below are the reasons to take towards ratifying a contract:

Step One: Study the agreement and ensure you understand its terms and conditions. You must develop a complete understanding of all the clauses which constitute the whole document. The reason is that you cannot ratify a selected aspect of the agreement. As a result, complete understanding and clarity are critical. However, if you encounter something you do not understand to the best of your ability, you can instantly call for voiding to invalidate it.

Step Two: Make a direct declaration which fully expresses your approval of the agreement. A direct declaration requires a written expression declaration that you approve and wish to enforce the contract.

Step Three: You must progressively honour the terms of the ratified contract. Essentially, once a contract is ratified, it becomes binding. Therefore, you are liable for any breach of contract.

Is backing Out of a Ratified Contract Possible?

A ratified contract is legally binding on all participating parties. It is impossible to back out of a ratified contract unless the other parties agree.

In this case, all the participants parties in the contract would have dissolved it. For example, ratification in real estate, a contract binds all conditions for purchase are lifted. This means the purchase agreement might not have been signed; the ratified contract to purchase remains binded.

Conclusion

Getting into a ratified contract requires utmost prudence, especially with voidable contacts. If you are looking for a paystub generator, watch out for eFormscreator, a 100% free tool.