Understanding your paycheck can be challenging, especially when faced with various abbreviations and deductions. One such term that might appear on your pay stub is “ER Health.” To clarify this and help you navigate your pay stub better, we’ll delve into the key components typically found on a pay stub. We’ll cover how to read it, understand its contents, and specifically, what “ER Health” means.

What Information Can You Find on Your Pay Stub?

A paystub generator provides a detailed breakdown of your earnings and deductions for a specific pay period. It’s essential for financial planning, verifying income, and ensuring that you are paid correctly. Here are some of the main pieces of information you might find:

- Employee Information: Your name, address, and employee identification number.

- Employer Information: Your company’s name and address.

- Pay Period: The start and end dates for the pay period.

- Earnings: Breakdown of your gross pay, including regular hours, overtime, bonuses, and commissions.

- Deductions: Amounts subtracted from your gross pay for taxes, insurance, retirement plans, and other contributions.

- Net Pay: The amount you take home after all deductions.

How Do You Read a Pay Stub?

Reading a pay stub involves understanding the various sections and what they represent:

- Gross Pay: Your total earnings before any deductions.

- Net Pay: Your take-home pay after deductions.

- Deductions: These can include federal and state taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and other withholdings.

Read more: fake income verification for apartment

What Exactly is on a Pay Stub?

Pay stubs typically contain the following sections:

- Income: Itemized list of your earnings, including base pay, overtime, bonuses, and other compensation.

- Taxes: Federal, state, and local taxes withheld.

- Benefits: Contributions to health insurance, retirement plans, and other benefits.

- Other Deductions: Union dues, charitable contributions, or wage garnishments.

- Employer Contributions: Payments made by your employer towards benefits like health insurance and retirement plans.

Related blog: How To Get A Pay Stub From Direct Deposit?

What Does ER Health on a Pay Stub Actually Mean?

“ER Health” stands for “Employer Health” and refers to the contributions your employer makes towards your health insurance premiums. This is not a deduction from your pay but an amount your employer pays on your behalf. Understanding this can give you a clearer picture of the total compensation you receive from your employer, which includes both your direct pay and these additional benefits.

Understanding the Deductions in Your Pay Stub

Deductions are amounts subtracted from your gross pay. They can be mandatory, like taxes, or voluntary, like retirement contributions. Here’s a closer look at some common deductions:

- Federal Income Taxes: Based on your income level and withholding allowances.

- State Taxes: Vary by state and are also based on your income.

- Social Security and Medicare: These are federal programs that provide benefits for retirees, the disabled, and children of deceased workers.

Don’t miss to read: Understand DG Paystubs

Understanding Federal Income Taxes

Federal income taxes are withheld based on the information you provide on your W-4 form. This includes your filing status and the number of allowances you claim. The IRS uses this information to determine the appropriate amount of tax to withhold from each paycheck.

Understanding State Taxes

State taxes vary widely. Some states have no income tax, while others have progressive tax rates. Your pay stub will show the amount of state tax withheld, which helps ensure you don’t owe a large amount when you file your state tax return.

Let’s Take a Look at Social Security

Social Security is a federal program funded through payroll taxes. Your pay stub will show the amount withheld for Social Security, which goes towards funding retirement, disability, and survivor benefits. The current withholding rate is 6.2% of your earnings, up to a certain limit.

In Conclusion

Understanding your pay stub is crucial for managing your finances effectively. “ER Health” represents the employer’s contribution to your health insurance, a valuable part of your total compensation package. By familiarizing yourself with the various components of your pay stub, you can ensure accuracy, plan your budget, and maximize your benefits.

FAQs

1. What does “ER Health” mean on my pay stub?

“ER Health” stands for “Employer Health” and refers to the contributions your employer makes towards your health insurance premiums. It is an employer-paid benefit and is not deducted from your paycheck.

2. How can I understand the deductions listed on my pay stub?

Deductions on your pay stub can include federal and state taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and other withholdings. Each deduction is itemized, showing how much is taken from your gross pay.

3. Why is it important to review my pay stub regularly?

Regularly reviewing your pay stub helps you ensure accuracy, understand your earnings and deductions, and manage your finances effectively. It also allows you to spot any errors or discrepancies in your pay.

4. What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, contact your employer or HR department immediately. They can help correct the mistake and ensure you receive the correct pay and benefits.

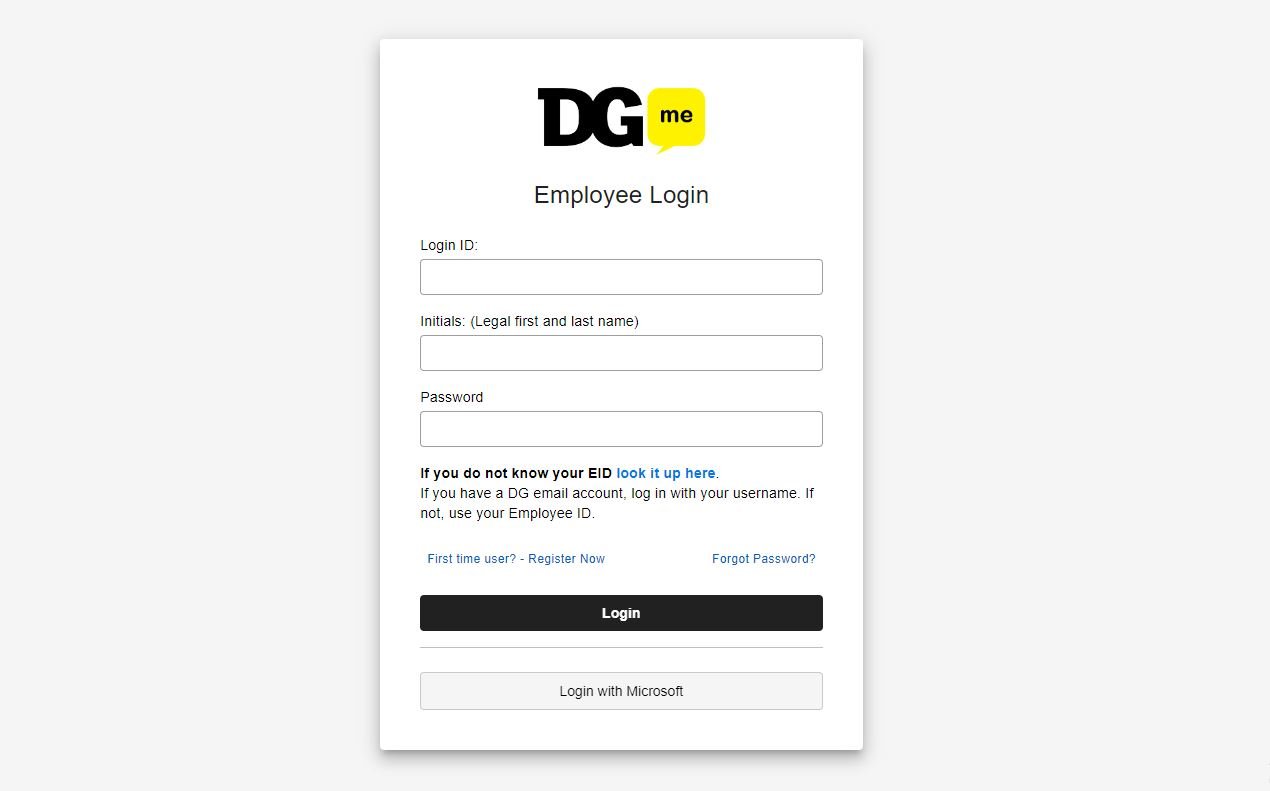

5. How can I get a pay stub if I have direct deposit?

Most employers provide electronic pay stubs accessible through payroll portals or sent via email. If you cannot find your pay stub, contact your HR department for assistance. Tools like a free pay stub generator can also help recreate your pay stubs if needed.

6. What is the difference between gross pay and net pay?

Gross pay is your total earnings before any deductions, while net pay is the amount you take home after all deductions, such as taxes and insurance premiums, have been subtracted.

7. Can I use a fake pay stub for income verification when renting an apartment?

Using fake income verification documents, including pay stubs, is illegal and can result in severe consequences, including legal action. Always use legitimate documents for income verification purposes.